March 29 CBSL Treasury Bond auction A repeat of last year’s controversy?

Posted on April 7th, 2016

CBSL issue bonds worth Rs 80 billion after calling bids for Rs 40 billion-Media Unit – ACF

The Anti-Corruption Front (ACF) has written to the Governor of the Central Bank of Sri Lanka (CBSL) requesting an explanation regarding the issue of treasury bonds worth Rs 80 billion on March 29, 2016.

It was the ACF that first exposed controversial Treasury Bond issue last year, although at that point neither the ACF nor its partners were fully aware of the gravity of the issue. However by now it is obvious that last year’s Treasury Bond issue was one of the biggest financial controversies in recent years. It is not clear that there were any malpractice/manipulation has taken place during March 29 auction, however there are indications that the process (on March 29) has run on parallel lines of last year’s controversial auction. That is the reason why the ACF has written to the Governor of CBSL, President and Finance Minister seeking an explanation of the process, so that there will no longer be room for doubt.

Highly suspicious

Chairman of the ACF, Ven Ulopone Sumangala Thera and Advisor of ACF, Rajith Keerthi Tennakoon quoting data from the CBSL said that the details surrounding the sale are highly suspicious.

Central Bank of Sri Lanka has issued treasury bonds worth Rs 80 000 million on March 29, although it initially announced that it will issue treasury bonds worth Rs 40 000 million (http://www.cbsl.gov.lk/pics_n_docs/02_prs/_docs/notices/notice_20160324eb.pdf). It is said that the figure was revised due to the high demand. It is suspicious that the CBSL issued twice as much treasury bonds as planned. In addition most of the bonds are those that will mature in 14 years and one month, which places the biggest burden on the CBSL,” said Chairman of the ACF, Ven Ulopone Sumangala Thera.

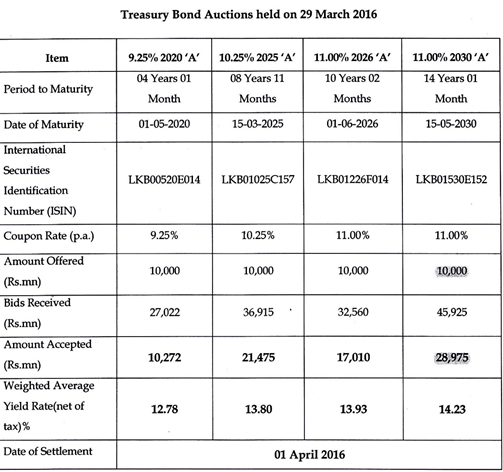

ACF stated that the bonds were issued via a primary dealer/s, but the identity of the dealers has not been revealed. Given below are the official data issued by the CBSL on the sale of Treasury Bonds.

ACF observations

Writing to the Governor of the Central Bank, President and the Finance Minister, ACF stated that the CBSL should answer the following concerns to ensure transparency of the process and to rebuild people’s faith in the Central Bank.

- The CBSL announced that it will issue treasury bonds worth Rs 40 000 million

- However on the auction held on March 29, 2016, the bid was oversubscribed and the CBSL ultimately issued treasury bonds worth Rs 80 000.

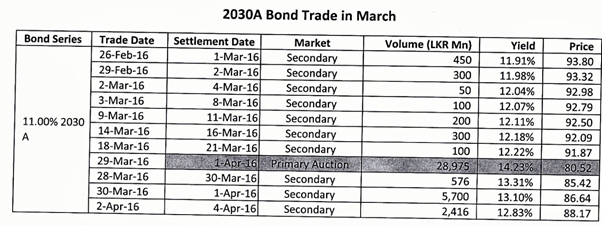

- CBSL issued a press release indicating that it issued bonds worth Rs 28 975 million in the segment of Rs 14 years and one month at a price of Rs 80.52 (at an interest rate of 14.23%). This gives rise to the following questions

3.1 Why did the CBSL which initially wanted to issue bonds worth RS 40 000 million ultimately issue Rs 80 000 million?

3.2 Why did the CBSL issue treasury bonds worth over Rs 28 000 million on the most expensive variety of treasury bonds

3.3 Who were the primary dealers present at the auction on March 29 who bid for the 14 years and one month variety of bonds? The volume of bonds obtained and at what interest?

Meanwhile ACF advisor Rajith Keerthi Tennakoon said that while the at this moment ACF does not directly state that there was a ‘scam’ akin to the one that transpired last year, the circumstances surrounding the March 29, 2016 treasury bond auction raises serious concerns on the transparency of issuing treasury bonds.

There must be a lot more transparency in the CBSL. The public must be made aware of how and why things happen, especially because of what happened last year. Transparency is the only way to dispel public doubts,” he said.

Attached herewith is the letter ACF sent to Governor of the Central Bank, President and the Finance Minister.

Media Unit – ACF

April 07, 2016.