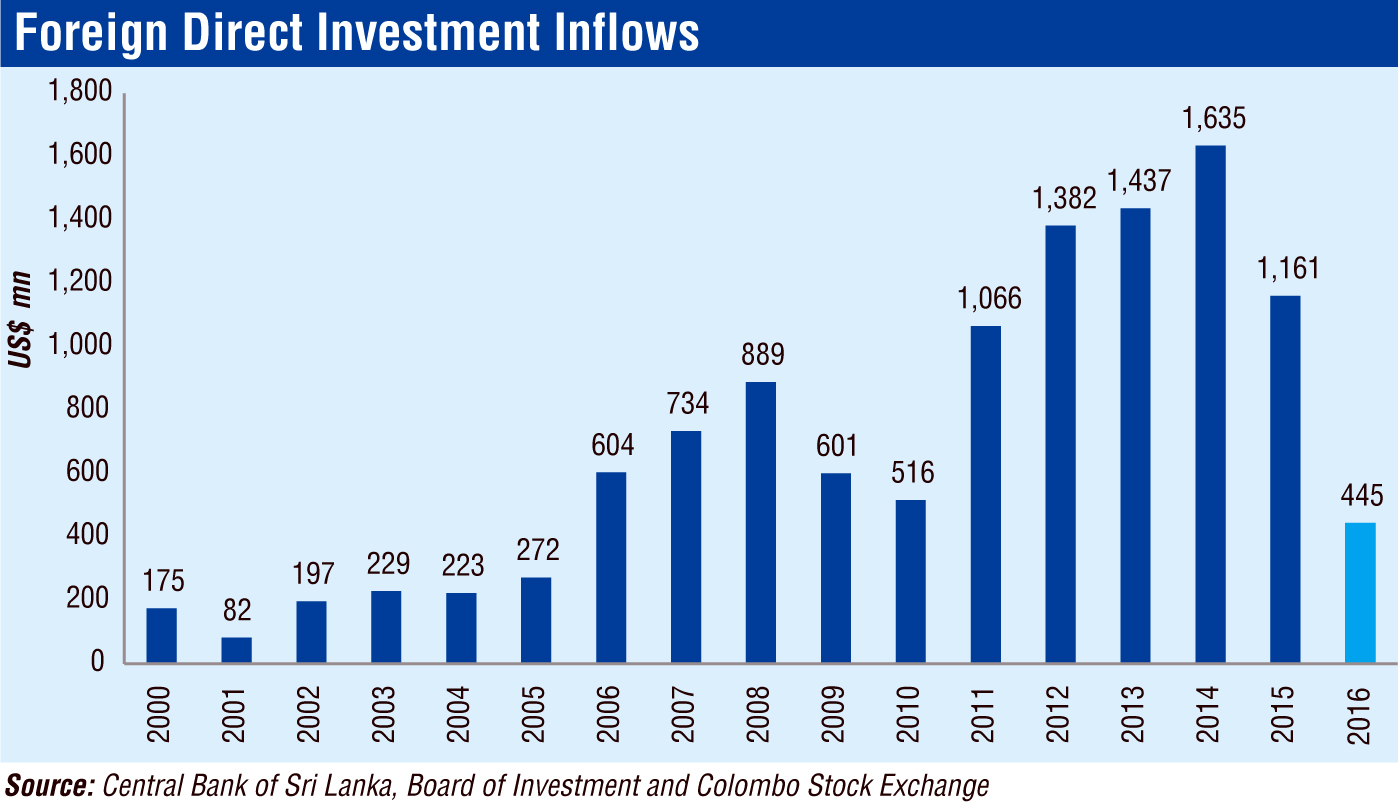

Sri Lanka’s foreign direct investment (FDI) in 2016 dips 54% to $ 450 m as policy inconsistency weighs

Posted on January 30th, 2017

Courtesy Daily FT

Reuters: Sri Lanka’s foreign direct investment (FDI) slumped 54% to reach an ‘extremely low by any standard’ level last year, the Government said on Friday as inconsistent tax and economic policies weighed on offshore investments.

The FDI dived 54% to $ 450 million in 2016 year-on-year, compared with $ 970 million in the previous year, which International Trade Minister Malik Samarawickreme stated was, Extremely low by any standard”.

He said the State-run Board of Investment (BOI) should promote investment, and if necessary, regulations and rules need to be changed to attract investments As the current regulations have failed to bring in investors”.

Prime Minister Ranil Wickremesinghe-led centre-right United National Party (UNP), which is in a coalition with President Maithripala Sirisena’s centre-left Sri Lanka Freedom Party (SLFP) promised to revive the economy with major FDIs.

Last year, the Government faced a debt and balance-of-payments’ crisis, and it also had to change its tax policies announced in the 2016 budget due to protests.

It is a lot to do with policy inconsistency on some of the key criteria like taxes and land ownership,” Shiran Fernando, an analyst at Colombo-based Frontier Research.

Still we see some uncertainty, in particular in the financial sector, due to the proposals outlined in the budget for 2017 in November.”

The Government also faced legal battles in raising the value added tax (VAT) by 4% to 15%, resulting in a loss of Rs. 100 billion due to a six-month delay in the implementation of the new tax.

The Government agreed for an economic reform agenda with the International Monetary Fund (IMF) for a $ 1.5 billion loan in June last year. That includes reducing budget deficit, allowing rupee flexibility, and reviving loss-making State-owned enterprises.

The IMF in November said Sri Lanka’s macro-economic and financial conditions have begun to stabilise and that the island nation’s performance under its $ 1.5-billion loan program was satisfactory.

http://www.ft.lk/article/594657/FDI-in-2016-dips-54–to—450-m-as-policy-inconsistency-weighs

January 30th, 2017 at 4:52 pm

This is damning for the UNP.

Now the country is in a debt crisis, balance of payment crisis, GDP growth crisis, foreign reserve crisis, export crisis and a FDI crisis. An unenviable place to be in.

So called analysts have got it all wrong. IMF has no relevance to this. IMF is part of the problem, not the solution. The $1.5 billion borrowed didn’t construct any income generating asset. That loan too has to be repaid with interest.

Clever investors should pull out their investments now or lose the dollar value of their investments in 2017 as the rupee will start to depreciate at an unprecedented speed.

This drop in FDIs (lowest in 11 years) is due to UNP government disrupting Chinese projects. It scares off all investors as they fear they inability to take out their money. VAT increase will worsen economic growth rate.

A massive FDI inflow for the Horana tyre factory was disrupted by the President over petty personal politics. How can the country overcome its crises like this?

The last time the country was in a massive balance of payment crisis was in 1981 and 1982. The 1983 riot and the mass exodus of people (and their inward remittances) overcame it by the end of 1983. Since then regular and large outflow of refugees and their inward remittances kept the balance of payment in good shape. As the war has ended and the northern economy recovered, there is no need for inward remittances. Their poor relatives are mostly self-sufficient today. Some of them even invest in foreign assets which is a drain on the country’s meagre foreign reserves.

January 30th, 2017 at 5:00 pm

This chart is fantastic promotional material for Mahinda. It clearly shows the economic disaster under the UNP and the prosperity under Mahinda.

Similarly, the GDP growth chart, foreign reserves chart (since end of the year), debt to GDP chart (although I disagree) and exports chart would clearly show UNP’s economic disaster and Mahinda’s success.

January 30th, 2017 at 6:33 pm

We agree with Dilrook !

It is plain to see that Investor Confidence has dropped rapidly under Yahap. This is natural as Yahap is seen to ‘Crash & Sell’ the country. Which Investor would put in money under such negative conditions ? RW Economic policies have failed.

The Jnt Opposition should use a part of this diagram print that on the front of T-shirts and distribute them for all to see !