Ministers of Justice and Health on collision course with association of banks

Posted on December 24th, 2023

By Shamindra Ferdinando Courtesy The Island

Wijeyadasa pushes for suspension of Parate executions:

‘Country paying heavy price for not having proper tax regime, favourable treatment to some’

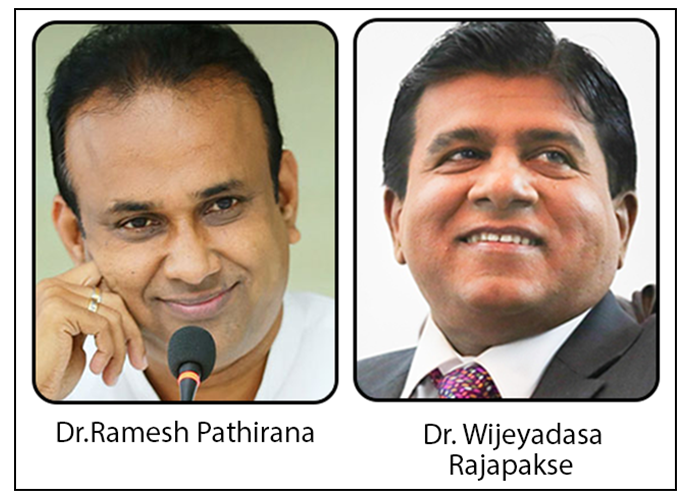

Justice, Prisons Affairs and Constitutional Reforms Minister Dr. Wijeyadasa Rajapakse, PC, has assured the local business community, troubled by parate executions, that laws will be brought in to regulate the practice. The Justice Minister said he would work with Health Minister Dr. Ramesh Pathirana to convince the Cabinet-of-Ministers to change the law.

The assurance was given at a meeting held at the Jasmin Hall, BMICH, where the former President of the Bar Association explained how the law meant to recover unpaid loans and interest thereon was brazenly abused.

The gathering was told that approximately 1,400 businesses were already in distress, especially in Colombo, due to the one-sided swift action taken by banks to recover unpaid loans by seizing and auctioning mortgaged properties without taking into consideration the political-economic-social crisis caused by the 2019 Easter Sunday attacks, followed by the Covid-19 pandemic and the subsequent economic crisis.

Minister Rajapakse said that either the existing law, the Banking Act no 30 of 1988, had to be overhauled or a new Act introduced to prevent the further deterioration of the economy.

Parate execution can be carried out only by the licensed commercial banks of Sri Lanka.

Following Dr. Rajapakse’s declaration, the Sri Lanka Banks Association (SLBA) stressed that the banks exercised what the Association called their legally-enshrined right to parate execution as a last resort. The Association declared that the overarching objective was to protect depositors’ funds that had been lent to borrowers.

The Association emphasised that the parate execution remedy is aimed at recovering mortgaged assets from willful defaulters and businesses that were no longer viable.

The SLBA, which represents all the licensed banks in the country, pointed out that banks have extended moratoriums on debt repayment for a long period exceeding 48 months in some cases, and that in instances of willful default by borrowers, the banks owe a duty to their depositors’ whose funds are at risk, to recover the debts overdue and minimize the losses on loans granted.

Legal sources pointed out that the association never bothered to issue statements when huge amounts of money recklessly lent and overdue from top end borrowers were written off as bad debts.

Minister Rajapakse told Friday’s meeting that before the change of government, in 1977, only the Bank of Ceylon, People’s Bank and State Mortgage and Investment Bank were empowered to carry out parate executions. However, subsequently private banks and financial institutions, having made representations to the then President, secured parliamentary approval to join the club.

The government disregarded the concerns expressed by the Bar Association at that time, the Justice Minister said, alleging there had been many instances of misuse at the expense of the clients experiencing financial difficulties.

Valuable properties that had been seized under parate execution had been bought for a song and then sold keeping a huge profit margin, the Justice Minister said, asserting that a deeply flawed law caused injustice.

Dr. Rajapakse warned unless the continuing manipulation of the law wasn’t stopped through an amendment to the existing Act or by introducing a new Act, the banks, too, would have to face far reaching consequences. The significant depletion of industrial and commercial borrowers under the dire current circumstances and significant weakening of the client base as a whole could have a negative impact on the entire banking system, the Justice Minister warned.

The President’s Counsel also questioned ‘irrevocable power of attorney’ that lenders obtain from borrowers over mortgaged properties while declaring his intention to bring in necessary amendments to restore public confidence in the system. The Minister pointed out that the ‘irrevocable power of attorney’ couldn’t be done away with. This is wrong and not practiced anywhere in the world,” the outspoken Minister said.

The government couldn’t forget that a section of the business community had been subjected to such unfair practices at a time the people were burdened with taxes and faced further increased levies, such as VAT from January 1, 2024. How could one do business under such difficult circumstances, the Dr. Rajapakse asked?

The MP, who had first entered Parliament, back in 2004, on the then PA National List, found fault with successive governments for failing to adopt a proper tax policy. Declaring that once adopted a particular tax regime should be in place for at least a decade, lawmaker Rajapakse pointed out how the country suffered for want of proper tax strategy.

The Minister told The Island that the way governments had handled the economy was questionable and those responsible owed the country an explanation and apology. Dr. Rajapakse questioned the utter failure on the part of the Central Bank to recover the loans granted to various failed finance companies. I raised this issue in Parliament recently but unfortunately those responsible are yet to take tangible measures in this regard,” Dr. Rajapakse said.

Referring to a declaration he made in Parliament on November 15, this year, Dr. Rajapakse said that Mercantile Credit, one of the beneficiaries of government grants, was yet to pay back Rs. 30,000 million it owed to the Central Bank.

The Minister said so during the debate on the Second Reading of Budget 2024.

It is a massive borrowing by a single entity that is more than what his Ministry’s vote amounts to,” Dr. Rajapakse said. Those behind the scheme hadn’t been punished, the Minister charged.