How Thai Traders deprive Sri Lanka of millions of dollars through misinvoicing

Posted on February 8th, 2024

by Gomi Senadhira Former Director General of Commerce, can be contacted via senadhiragomi@gmail.com.) Courtesy The Island

Fig.01

A few years ago, a Washington-based consultancy group, Global Financial Integrity (GFI), released a shocking report on how countries lose billions of dollars through illicit financial flows. One of the main instruments through which such illicit financial flows occur is trade misinvoicing by importers and exporters who deliberately falsify the stated prices on invoices (underinvoicing exports and overinvoicing imports). That report pointed out that Sri Lanka lost on average US$1.6 billion per year during the period 2008–2017. In 2017, the loss was US$1.85 billion.

The report is largely based on the analysis of data submitted by governments each year to the United Nation’s Comtrade database. Though some differences in data are possible due to the cost of shipping and insurance, those cannot account for some of the large gaps in the data. When those large gaps are closely scrutinized, line by line, the true magnitude of misinvoicing can be identified.

The table below illustrates the significant value gap in Sri Lanka’s trade with Thailand, which signals the possibility of large-scale misinvoicing. In 2022, the value gap, most of which could result from overinvoicing imports and underinvoicing exports, was $64.5 million. This was higher than the total export value recorded by Sri Lankan Customs ($57.7 million). By addressing this problem through a customs cooperation arrangement (which does not require a comprehensive FTA) Sri Lanka may be able to gain up to $50 million. That is much higher than the projected gains from the FTA! In addition to that, a substantial amount could be collected as additional taxes. (See Fig. 1)

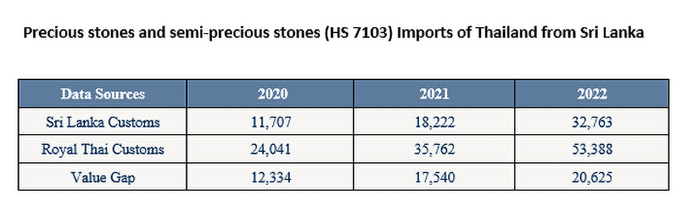

Interestingly, the gap in export data is mainly due to large gaps between Sri Lankan export data and Thai import data for precious stones and semi-precious stones (HS 7103). These gaps, illustrated in the table below, point to the possibility of large-scale underinvoicing by Sri Lankan and Thai gem traders. In 2022, Sri Lanka’s precious stones and semi-precious stones (HS 7103) exports were valued at $32.7 million by Sri Lankan Customs. However, during that year, Thailand imported $53.3 million worth of precious stones and semi-precious stones from Sri Lanka. The value gap was $20.6 million. (See Fig. 2)

It is widely known within the gem industry how Thai traders manipulate prices in the gem market and avoid paying taxes through false declarations. A few months ago, this was even raised at the Parliament’s Sectoral Oversight Committee on Environment, Natural Resources, & Sustainable Development, chaired by Mr. Ajith Mannapperuma. During the discussion Sri Lankan gem traders complained that they are at disadvantageous position by price manipulation and false declarations by Thai gem merchants and urged government to intervene.

Did our negotiators, or the Sri Lankan Embassy in Bangkok, address this issue during the five years of negotiations?