Dismantling US$ dominance: De-dollarization strategies

Posted on January 16th, 2024

Courtesy The Island

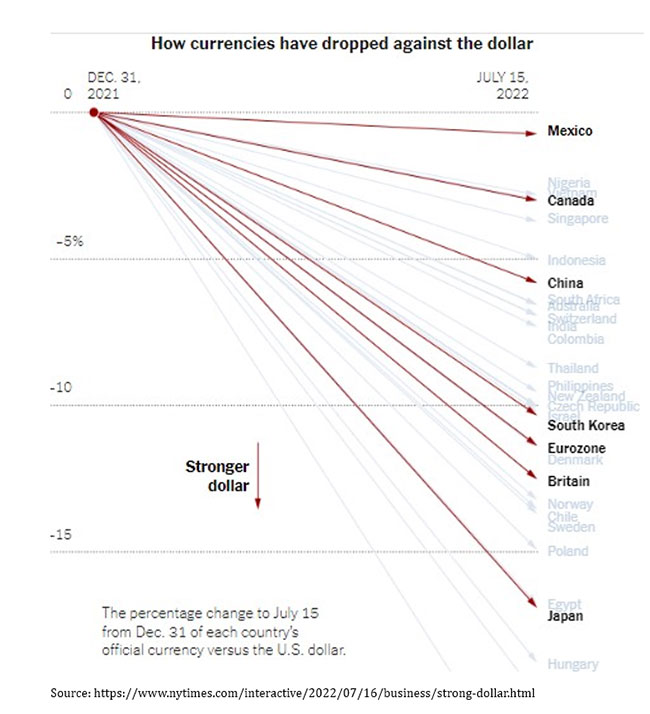

The impact of the US dollar’s dominance as the primary international currency, termed the US dollar trap,” on poor, developing, and emerging economies. The consequences encompass financial stability and dollarization, with monetary policy constrained by the dollar’s influence. A stronger dollar negatively affects trade and finance in emerging markets, causing a decline in real trade volumes. The dollar’s status as the global reserve currency leads to dissatisfaction among strategic competitors, potentially challenging US hegemony in the global financial system. Despite claims of instability, the dollar’s global role has provided substantial benefits to the US economy since the 1960s. (See Figure 01)

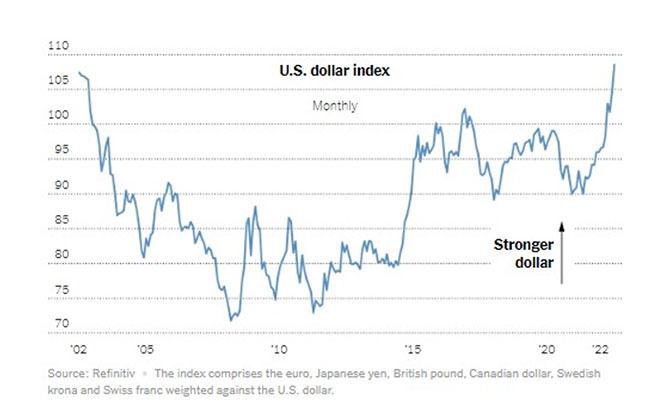

The primary method of assessing the strength of the dollar involves comparing it (indexing) to a basket of currencies from significant trading partners, such as Japan and the euro-zone. By this standard, the dollar is currently at a two-decade peak, having surged by over 10 percent this year. This substantial movement is noteworthy for an index that generally experiences minor fluctuations on a daily basis. (See Figure 02)

Transformation

The value of the U.S. dollar is the strongest it has been in a generation, devaluing currencies around the world and unsettling the outlook for the global economy as it upends everything, from the cost of a vacation abroad to the profitability of multinational companies. However, this U.S. dollar’s long-standing dominance in the international arena is facing new challenges, raising questions about the phenomenon of de-dollarization. Recent geopolitical events, particularly the Russia-Ukraine crisis and the resultant U.S. sanctions on Russia, have triggered a reconsideration of the global reliance on the U.S. dollar. Notable instances, such as Bolivia’s adoption of the Chinese currency known as renminbi-RMB, like sterling of Great Britain (the currency unit is yuan-Y, like British pound, for example) for imports and exports, highlight a growing trend toward reducing dependence on the dollar in international transactions. Argentina and Brazil had already initiated the use of yuan in their trading settlements. Argentina, in April 2023, announced plans to use Chinese currency to pay for goods imported from China; while Brazil, in February 2023, signed a memorandum of cooperation with China to establish yuan clearing arrangements in Brazil. Meanwhile, the State Bank of India completes its first non-dollar transaction with Sri Lanka by paying Sri Lanka rupees for exports.

Renminbi and Yuan

Renminbi is the official currency of the People’s Republic of China and means people’s currency” in Mandarin. A yuan is a unit of the currency. A popular analogy draws from the British pound sterling vs. the pound: Renminbi is the name of China’s currency, just as sterling is the currency of Great Britain. A unit of renminbi is a yuan, just as the pound is the basic unit of sterling.

Expansion of BRICS

This shift has been particularly noticeable within a group of influential emerging economies, collectively known as BRICS—Brazil, Russia, India, China, and South Africa. On Aug 24, 2023, BRICS announced that it would formally accept six new members at the start of 2024: Saudi Arabia, Iran, Ethiopia, Egypt, Argentina, and the United Arab Emirates (UAE). (See Figure 03)

Challenges to Dollar Hegemony

The impact of de-dollarization could unfold through two primary scenarios. Firstly, events that undermine the perceived safety and stability of the U.S. dollar may contribute to its erosion. Secondly, positive developments that enhance the credibility of alternative currencies might further challenge the dollar’s dominance. The repercussions of de-dollarization could extend to a broad depreciation of U.S. financial assets, prompting shifts in global economic dynamics. However, the precise impact on U.S. growth remains uncertain, with potential effects on competitiveness, foreign investment, and inflation.

Emerging Signs and Scenarios

While signs of de-dollarization are becoming evident, the U.S. dollar continues to exert influence in various markets. China’s efforts to internationalize the renminbi are ongoing but are characterized by a gradual process. Measures such as relaxing capital controls, opening markets, and promoting Chinese government bonds aim to position the renminbi as a credible alternative. In currency markets, the dollar maintains a substantial share, accounting for 88% of foreign exchange volumes. However, foreign exchange reserves indicate a decline to a record low of 58%, signaling a shift away from the dollar.

De-Dollarization in Oil Markets

Notably, de-dollarization is observable in oil markets, where the U.S. dollar’s influence on oil prices is waning. An increasing number of oil transactions occur in non-dollar currencies, particularly the renminbi. Countries, including Russia, are opting to sell oil in local currencies or those of allied nations. The significance of the dollar in determining oil prices has diminished, with OECD oil inventories playing a more dominant role.

Expectations and Regional Shifts

While a complete and rapid de-dollarization is deemed unlikely, there is an expectation of marginal de-dollarization. The more plausible scenario involves partial de-dollarization, where the renminbi assumes some functions traditionally associated with the dollar. This shift could lead to regionalism, creating distinct economic and financial spheres of influence characterized by different currencies and markets. The U.S. dollar’s enduring global network of alliances and partnerships remains a significant factor contributing to its continued prominence despite the evolving landscape of international currencies.

Conclusion

In conclusion, the dominance of the US dollar, known as the US dollar trap,” has profound implications for poor, developing, and emerging economies. Despite providing significant benefits to the US economy since the 1960s, recent geopolitical events, such as the Russia-Ukraine crisis, have triggered a reassessment of global reliance on the dollar. Instances like Bolivia’s adoption of the Chinese currency and Argentina and Brazil’s initiation of yuan settlements indicate a growing trend to reduce dependence on the dollar. The expansion of BRICS with 11 member nations reflects efforts to diversify financial interactions. Challenges to dollar hegemony may arise from events undermining stability or positive developments favoring alternative currencies. Signs of de-dollarization, particularly in oil markets, suggest a shift toward regionalism with distinct economic spheres. Despite these shifts, the enduring global network of alliances contributes to the continued prominence of the US dollar.

(The writer, a senior Chartered Accountant and professional banker, is Professor at SLIIT University, Malabe. He is also the author of the Doing Social Research and Publishing Results”, a Springer publication (Singapore), and Samaja Gaveshakaya (in Sinhala). The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the official policy or position of the institution he works for. He can be contacted at saliya.a@slit.lk and www.researcher.com)