Income Tax Dept : Notice for all overseas Sri Lankans

Posted on March 9th, 2024

Courtesy NewsIn.Asia

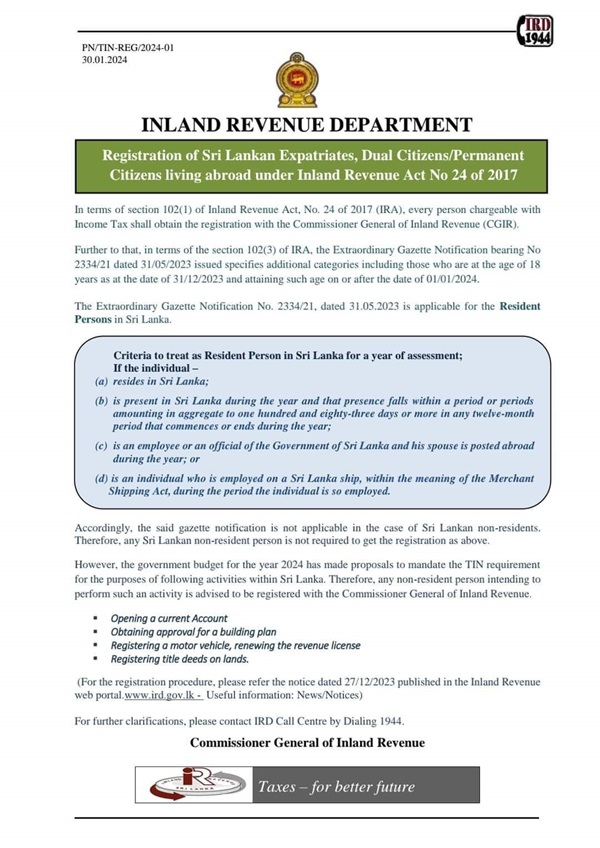

Sri Lanka’s Inland Revenue Department (IRD) has issued a notice outlining the requirements for Sri Lankan non-residents concerning the Tax Identification Number (TIN).

According to the IRD, Sri Lankan residents above 18 years of age are chargeable with income tax and are required to obtain registration with the Commissioner General of the IRD.

Subscribe to our Telegram channel for the latest updates from around the world

ADVERTISEMENT

However, Sri Lankan non-residents are not required to obtain the said registration with the Commissioner General of the IRD.

Instead, Sri Lankan non-residents will be required to obtain the Tax Identification Number (TIN) for four key activities as proposed in the Budget 2024.

The four key activities are as follows;

- Opening a current account

- Obtain approval for a building plan

- Registering a motor vehicle, renewing the revenue licence

- Registering title deeds on lands

The IRD notice the registration requirements for Sri Lankans and non-residents is as follows;

Tags: Sri Lanka