Sri Lanka’s Tax Conundrum – 2022

Posted on October 23rd, 2022

By Sanjeewa Jayaweera Courtesy The Island

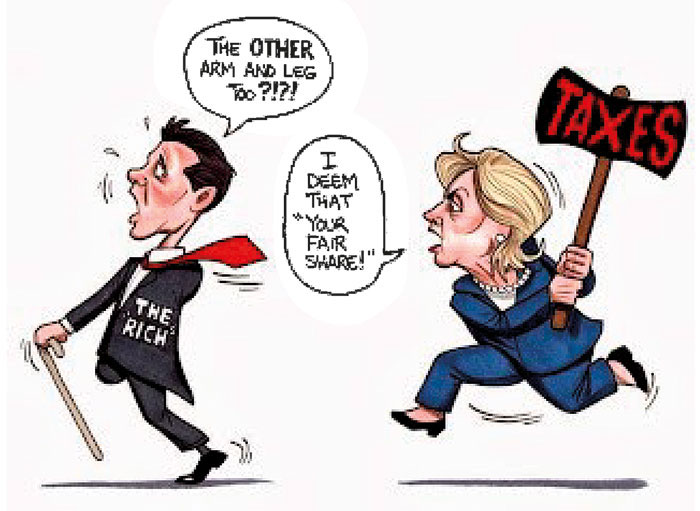

Despite the old saying, the only sure things in life are death and taxes,” most of those working in Sri Lanka have never paid direct taxes, and those who pay have been enjoying relatively low taxes rates for several decades. We have also been spared a multitude of other taxes, such as inheritance, wealth and capital gains, that citizens of most developed and developing countries need to pay. So, the publication of the Gazette setting out the proposed increase in changes to tax rates and thresholds to be effective from October 01, 2022, seems to have set the cat amongst the pigeons!

A great deal of indignation and fury as to the impact on their disposable income and lifestyle have been expressed by many over the media and social media. In addition, concern has been expressed that the country will lose many skilled professionals who might migrate to countries with higher tax rates and compliance of nearly 100%!

The corporate sector, which is also being impacted, has demanded from the government greater restraint, accountability, and transparency on its spending. Unfortunately, we Lankans, have, in addition to accepting corruption as part of our country’s DNA, turned a blind eye to the civic responsibility of being a tax-compliant citizen for multiple reasons.

It reached a zenith in the year 2020 when Gotabaya Rajapaksa was elected President and proceeded to be the Santa Claus” by substantially reducing tax rates, increasing the tax-free threshold for individuals, doing away with certain taxes, and eliminating the well-established means of collecting taxes at source by abolishing PAYE and WHT.

It was absolute madness and a recipe for economic Armageddon which we are, sadly. in the midst of. The impact of the tax cuts is estimated to be around LKR 700 billion. In my article published in the Sunday Island of January 12, 2020, captioned Sri Lanka’s Tax Conundrum”, I highlighted the inherent risks of the tax cuts and stated, Based on the Household Income and Expenditure Survey of 2016 and the dispersion of the average household income, the recently introduced tax rates and increase in the threshold will only benefit a smaller segment of the population who in all probability do not need this type of assistance from the government.

I say this at the risk of getting a sharp poke in my ribs from some of my former colleagues still in employment. In my case, had I been in employment, the incremental income would most probably be spent on a few additional overseas trips, buying a few expensive imported branded gadgets and a higher-class BMW.Therefore, I am not sure I would have contributed to the increase in aggregate demand for our GDP. As to how a household spends, the incremental income would certainly depend on their income level. However, there is no doubt the greatest beneficiaries would be those who are not currently struggling to make ends meet.”

Not too many expressed such concerns because many were delighted that they would receive a windfall. But, unfortunately, those irresponsible and hare-brained decisions have seen tax revenue as a percentage of GDP declining to 7.3% inclusive of the covid impact when it should be around 15% for a developing country. So, the need to reverse those irresponsible tax cuts and increase our tax revenue is a fact that needs to be understood and appreciated.

Taxation, Purposes and Justification

Taxation is when a taxing authority, usually a government, levies or imposes a financial obligation on its citizens or residents. Since ancient times, paying taxes to governments or officials has been a mainstay of civilization. The government compels taxation through an implicit or explicit threat of force. Taxation is legally different from extortion because the imposing institution is a government, not private actors. The formulation of tax policies is one of the most critical and contentious issues in modern politics.” (Investopedia)

The most basic function of taxation is to fund government expenditures. Varying justifications and explanations for taxes have been offered throughout history. Before, taxes were used to support the ruling classes, raise armies, and build defences.

Later justifications have been offered across utilitarian, economic, or moral considerations. Proponents of progressive levels of taxation on high-income earners argue that taxes encourage a more equitable society. Higher taxes on specific products and services, such as tobacco or gasoline, have been justified as a deterrent to consumption.

Which Country Has the Highest Income Taxes?

As of 2022, the top 10 countries with the highest marginal income taxes (the rate on the top slab) are:

Ivory Coast – 60%, Finland – 56.95%, Japan – 55.97%, Denmark – 55.90%, Austria – 55.00%, Sweden – 52.90%, Aruba – 52.00%, Belgium – 50.00%, Israel – 50.00%, Slovenia – 50.00%

In South Asia, the highest marginal rates are:

India 30%, Pakistan 35%, Bangladesh 30%. In India, there is a 10% income tax surcharge on certain taxpayers, and the single-person tax-free allowance is INR 250,000 for a year.

So the Sri Lankan marginal rate of 36% is not as outlandish as it appears, although it is being imposed at a time when inflation is over 70% which is a challenging proposition.Research indicates those living in Nordic countries with the highest rates of taxes are often deemed the happiest!

Why do we hate to pay taxes?

Because as often as not, tax dollars get spent for things the public neither wants nor needs and would not choose to pay for. I wouldn’t mind taxes so much if all my tax money was spent wisely and in agreement with my perspectives.” (origin of quote unknown)

No nation grew prosperous by taxing its citizens beyond their capacity to pay. We have a duty to ensure that every penny that we raise in taxation is spent wisely and well.” (Margaret Thatcher)

I believe the above quotes capture most taxpayers’ feelings in Sri Lanka and the world. The word spent wisely” is a dilemma for all of us as our politicians are everything but wise!

Public Sector Salaries and Pensions

Currently, nearly 80% of government revenue is spent paying public sector salaries and pensions. Although an efficient and lean public service is a must and should attract some of the country’s best talent, successive governments abused their authority by giving jobs to their supporters when there was no vacancy.

In many developed countries, unemployed people are paid an unemployment benefit for a certain period of time. In Sri Lanka, those who govern have given unemployed people jobs for life, including a pension! The net result is that we have a bloated and inefficient public sector that is a drain on taxpayer money.

Defence Expenditure

The appropriation bill for 2023 submitted to parliament requests that LKR 360 billion be allocated to the forces and a further LKR 116 billion to the police; in contrast, only LKR 184 billion and LKR 267 billion are being allocated to education and health.A justifiable question of whether this allocation falls within the definition of spending wisely” needs to be responded to by the government. Undoubtedly, the bulk of the expenditure is spent on remuneration and not acquiring equipment.

Recently a former cabinet minister, much disliked by the public, raised a question in parliament as to why we need an armed force of 250,000 when there is no ongoing conflict or any such possible threat in the foreseeable future.

This matter was also widely discussed on a TV chat show by several prominent social activists and commentators. The consensus was that the defence budget needed to be reduced and the savings be allocated to education and health.I appreciate that there will be comments that pruning defence spending smacks of ingratitude to soldiers who fought during the civil conflict. However, given that 13 years have passed since the end of the conflict, it is time that the government take steps to demobilize and retrain the excess soldiers.

The Inland Revenue Department (IRD)

The mission statement of the IRD is To collect taxes in terms of relevant tax and other related laws, by encouraging voluntary compliance while deterring tax evasion and tax avoidance, and to enhance public confidence in the tax system administered by the Department of Inland Revenue by administering relevant tax and other related laws in a fair, friendly and expeditious manner and thereby facilitate a beneficial tax culture.”

Despite this mission statement, most will agree that the IRD has not performed. Voluntary compliance has not worked, and neither has constantly changing governmental tax policies assisted. My own experience is that IRD officers tend to go after those who are currently paying taxes for additional taxes rather than identifying those who are evading taxes.

That the department should be assisted with cutting-edge technology is to state the obvious. Whether the RAMIS system has facilitated this is questionable, although most corporates and a few individuals submit their tax returns through the system. A critical KPI for the department should be how many forced registrations were done during the year and how much tax, including back taxes and penalties, was collected from such registrations.

Tax Avoidance and Evasion

The difference is that tax avoidance is an action taken to minimize tax liability, whereas tax evasion is the failure to pay or deliberate underpayment of taxes. Reducing tax liability and deliberate underpayment of taxes can sometimes be a fine line. My interaction with many small and medium enterprises (SMEs) is that many don’t pay taxes or that what they do pay is minimal. In addition, many professionals are assumed to be non-compliant.

Many years ago, the GMOA and some professional bodies were lobbying the government to reduce their income tax rate from 24% to 16% after the Supreme Court dismissed their plea. The request was for professionals to be included within the definition of an SME who enjoyed a tax rate of 14%!

There is no doubt that many who should be paying direct taxes are not in the tax net as they should be. It is up to the IRD to ensure that they live up to their mission.

Conclusion

As I write this article, the President has on TV explained the reasons for higher direct taxes and that the IMF program is contingent on these mandated rates. Those conversant with economics and finance will appreciate the need for higher taxes for our country to come out of this self-inflicted economic disaster. But we must grit our teeth, curse the politicians, and pay up.

However, it is vital that the government spend our money transparently and not be profligate. We, the citizens, must be at the forefront of demanding that corruption among politicians cease, expenditures are rationalized, and those responsible are held accountable.